Venture capital firm Sequoia Capital announced on June 6 that it is splitting into three entities: the United States, China, and India & Southeast Asia. The firm said the move was necessary because its portfolio companies in these geographies have grown large enough to overlap and create territorial conflicts.

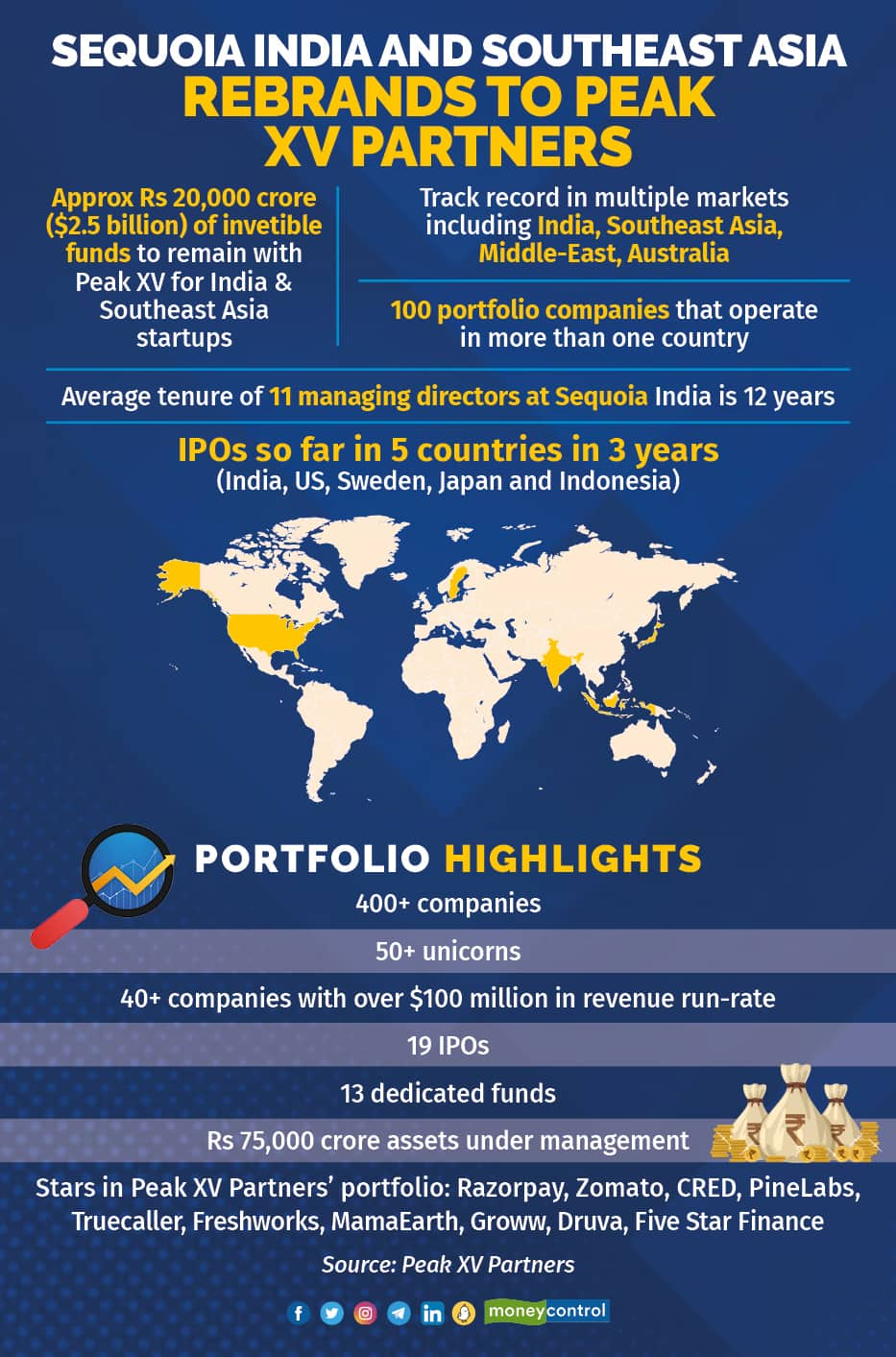

The India and Southeast Asia arm has been rebranded as Peak XV Partners and will now operate as a fully independent firm. It will continue to manage $9.2 billion across 13 funds and invest in startups using the $2.5 billion of uninvested capital that remains in Sequoia’s corpus.

“New beginning for us as Peak XV Partners. The firm will continue to be led by the present leadership team. It will continue to invest from the recently raised set of funds. The new structure will open up an unbounded global opportunity and create more value for founders and LPs,” said Shailendra Singh, managing director of Sequoia India.

“No change in the way we manage our portfolio relationships. Companies are emerging from every region with global ambitions and strategies for each region and business units have diverged. The scale and market leadership was causing brand confusion, portfolio conflict,” he added.

The rebranding comes in the wake of multiple controversies at Sequoia invested startups in India.

According to an industry source, “the 3 percent management fee and 30 percent carry structure that Sequoia’s partners in India enjoyed on the back of the legacy VC firm’s brand may not be feasible anymore. They now may have to resort to industry standards of 2 percent management fee and 20 percent carry from the funds. Moreover, international LPs cannot be expected to plough the huge sums that they put behind the Sequoia brand to invest in India and Southeast Asia going forward.”

However, a person close to Sequoia said that the management fee and carry will be the same.

“There used to be cross-sharing of carry between the 3 entities, a lot of the fundraising used to be driven by Sequoia US… It was easier to raise money as Sequoia or Accel versus us,” said a source close to the developments.

“This changes everything… They enjoyed a reputation on the back of the Sequoia brand, being associated with the biggest name from the Valley active in India and a part of the Sequoia global fraternity,” said another source.

“Since its inception, Sequoia Capital (US/Europe), Sequoia China and Sequoia India/SEA have been built as separate businesses with independent investment decision-making. Over the years, the strategies for each business have diverged and the scale and market leadership across different geographies has started to result in brand confusion and portfolio conflict. This has led the leaders of each business to collectively decide to move to fully independent partnerships with distinct brands, in order to serve founders and Limited Partners in the best manner,” the VC firm said in a statement.

“We are seeing companies emerge from every region with global ambitions. The flexibility that comes with the new structure will open up an unbounded global opportunity and help create more value for our founders and LPs,” Singh said.

Over the last 17 years, Sequoia India & SEA has raised 13 funds, and invested in over 400 startups, with more than 50 companies valued at $1 billion and above. The portfolio has seen 19 IPOs and multiple successful M&As resulting in $4.5 billion of realised exits so far. The investment team is led by 11 managing directors with an average tenure of over 12 years at the firm.

Peak XV Partners will continue to invest across stages (seed, venture, growth) and sectors like SaaS, AI, developer tools, cyber security, cloud infrastructure, climate tech, fintech, healthtech and consumer. The firm will further strengthen its unique and industry-leading programs like Surge and Spark which have been very well received by founders, the statement added.

“The firm remains committed as ever to help audacious founders build iconic companies that can be regional and global category leaders,” Peak XV said in a statement.

Surge programme to remain unaffected

One of Sequoia India & Southeast Asia’s main efforts in the last few years has been its Surge programme, through which it scouts for idea and seed stage investments in these geographies. After the startups are selected, they are put through an accelerator programme and connected to mentors who are founders of other Sequoia companies.

Rajan Anandan, who held the designation of managing director in Sequoia till now and headed the Surge programme, told the early-stage founders that the programme will continue to function in the same way.

“We continue to cherish and be grateful for your partnership; there will be no change in the way we engage and work with you. Surge as a program will continue, and you all will continue to remain in our Surge community. From today, Surge will be ‘Peak XV Partners’ rapid-scale up program,” Anandan wrote.

“Peak XV was the original name given to Mount Everest and symbolises the relentless pursuit of audacious goals by founders. We’re super excited to begin a new chapter but one that’s built on top of a super strong foundation,” he added.